Relevant Legal Provisions

Section 31(3)(f) of The CGST Act, 2017 | Requirement of Self-Generated Invoice

“a registered person who is liable to pay tax under sub-section (3) or sub-section (4) of section 9 shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered on the date of receipt of goods or services or both;”

When Self Generated Invoice has to be generated and Format | RCM Share on XSection 31(3)(f) of The CGST Act, 2017 | Requirement of Payment Voucher

“a registered person who is liable to pay tax under sub-section (3) or sub-section (4) of section 9 shall issue a payment voucher at the time of making payment to the supplier”

Second Proviso to Rule 46 | Self Invoice can be prepared Monthly

“Provided further that where an invoice is required to be issued under clause (f) of sub-section (3) of section 31, a registered person may issue a consolidated invoice at the end of a month for supplies covered under sub-section (4) of section 9, the aggregate value of such supplies exceeds rupees five thousand in a day from any or all the suppliers”

Gist:

Registered person has to prepare invoice itself addressed to himself (i.e. recipient details and supplies details shall be same) at the end of each month whenever he procures taxable goods or services or both from unregistered person and tax on same has to be paid under reverse charge mechanism.

Provisions of Section 9(4) of The CGST Act, 2017 is not applicable (w.e.f. 13th october 2017) however it may be noted that that concept discussed above is still in force for cases covered under section 9(3)

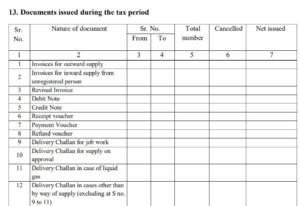

Data to be reported in Form GSTR-1

Excel format of Self-Generated Invoice may be downloaded from here

Excel format of Payment Voucher may be downloaded from here

[Disclaimer: Views expressed herein are based on our short readings of the relevant provisions, I assume no responsibility therefore. In no event, I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.]

Mr. Setia is a CA by Profession and expert in the field of Indirect Taxation Based in Delhi. Rich experience of over 5 year.