“INSTANT PAN THROUGH AADHAAR BASED E-KYC – DIGITAL REVOLUTION”

Key highlight:

- FM launches facility of Instant PAN through Aadhaar based e-KYC

Decoding the Circular:

Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs has launched the facility for instant allotment of PAN (on near to real time basis).

- About the facility availability:

Facility is available for those PAN applicants who:

- possess a valid Aadhaar number and

- have a mobile number registered with Aadhaar.

- The allotment process is paperless and an electronic PAN (e-PAN) is issued to the applicants free of cost.

- This announcement was announced in the Union Budget, 2020

Para 129 of the Union Budget, 2020: In order to further ease the process of allotment of PAN, soon we will launch a system under which PAN shall be instantly allotted online on the basis of Aadhaar without any requirement for filling up of detailed application form.”

Key Facts:

- ‘Beta version’ on trial basis was started on 12th Feb 2020 on the e-filing website of Income Tax Department.

- 6,77,680 instant PANs have been allotted with a turnaround time of about 10 minutes, till 25th May 2020.

- as on 25.05.2020, a total of 50.52 crore PANs have been allotted to the taxpayers,

- out of which, around 49.39 crore are allotted to the individuals and more than 32.17 crore are seeded with Aadhaar

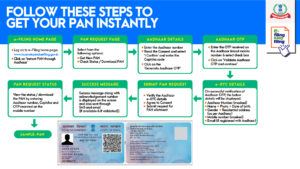

- About this Process:

- process of applying for instant PAN is very simple.

- Instant PAN applicant is required to access the e-filing website of the Income Tax Department

- provide her/his valid Aadhaar number and then submit the OTP received on her/his Aadhaar registered mobile number

Post successful completion:

- a 15-digit acknowledgment number is generated.

- Status Check: anytime by providing her/his valid Aadhaar number

on successful allotment,

Applicant can download the e-PAN. The e-PAN is also sent to the applicant on her/his email id, if it is registered with Aadhaar.

Steps to be followed for PAN Application

This Instant PAN Facility is a digital revolution and will promote ease of compliance to the taxpayers.

Link – source:

Source: https://www.pib.gov.in/PressReleseDetail.aspx?PRID=1627434

Disclaimer:

IN NO EVENT THE AUTHOR SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM OR ARISING OUT OF OR IN CONNECTION WITH THE USE OF THIS INFORMATION. THIS HAS BEEN SHARED FOR KNOWLEDGE PURPOSES ONLY.