Key Decision and Recommendations of 40th GST Council Meeting

GSTR-3B for May, June and July 2020 for small taxpayers

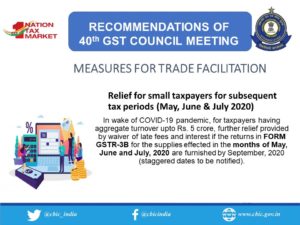

Relief for small taxpayers (aggregate turnover uptoRs. 5 crore) | GSTR-3B for May, June and July, 2020

Waiver of late fees and interest if the returns in FORM GSTR-3B for the supplies effected in the months of May, June and July, 2020 are furnished by September, 2020 (staggered dates to be notified)

Revocation of cancellation of registration

Where a registration has been cancelled till 12th June, 2020; Opportunity is being provided for filing of application for revocation of cancellation of registration up to 30th September, 2020.

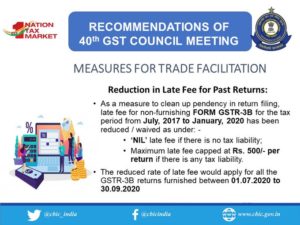

Reduction in Late Fees

Reduction in Late Fees | July 2017 – January 2020

-

- NIL Liability – NIL Late Fees

- Maximum Late Fees – INR 500 per return if there is liability

Applicable for all GSTR-3B filed between 1st July, 2020 to 30th September 2020.

Further Reliefs for small taxpayers | Feb, March and April 2020

Relief for small taxpayers (aggregate turnover uptoRs. 5 crore) | Interest on late filing of February, March and April 2020

Rate of interest for late filing beyond staggered due dates is reduced from 18% per annum to 9% per annum till 30th September, 2020.

In other words, for these months, small taxpayers will not be charged any interest till the notified dates for relief (staggered upto 6 July 2020)and thereafter 9% interest will be charged till 30.09.2020.

Finance Act, 2020 | Applicable from 30th June 2020

Certain clauses of the Finance Act, 2020 amending CGST Act 2017 and IGST Act, 2017 to be brought into force from 06.2020.

Press Release on Recommendations of GST council related to Law &Procedure

(Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. We shall not be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information in any circumstances.)

Mr. Setia is a CA by Profession and expert in the field of Indirect Taxation Based in Delhi. Rich experience of over 5 year.