What is Overseas Direct Investment?

Direct investment outside India means investment made in Joint Venture (JV)/ Wholly Owned Subsidiary (WOS) by way of

- Contribution to the capital or subscription to the Memorandum of Association of a foreign entity but does not include portfolio investment; or

- by way of purchase of existing shares of a foreign entity either by market purchase or private placement or through stock exchange, signifying a long-term interest in the foreign entity.

Definition of Joint Venture (JV) and Wholly Owned Subsidiary (WOS)

“Joint Venture (JV)”/ “Wholly Owned Subsidiary (WOS)” means a foreign entity formed, registered or incorporated in accordance with the laws and regulations of the host country in which the Indian party/Resident Indian makes a direct investment;

A foreign entity is termed as JV of the Indian Party/Resident Indian when there are other foreign promoters holding the stake along with the Indian Party. In case of WOS entire capital is held by the one or more Indian Party/Resident Indian.

Indian Party: An Indian Party is:

- a Company

- a body created under an Act of Parliament

- Registered Partnership Firm*

- Limited Liability Partnership (LLP)

- Any other entity in India as notified by RBI

A combination of the above entities can also form an “Indian Party”.

* Only those Partnership firms which are registered under Partnership act can make outside investment through automatic route. Unregistered Partnership firms require approval of RBI before making any outside investment.

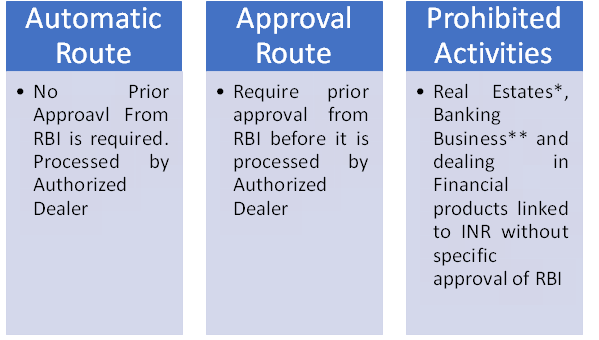

Regulatory Approach to ODI

To regulate the Overseas Direct Investment, RBI had notified:

Notification No. FEMA 120/RB-2004 dated July 7, 2004, as amended from time to time. A Master Direction titled ‘Master Direction on Direct Investment by Residents in Joint Venture (JV) / Wholly Owned Subsidiary (WOS) abroad’ has been issued.

Liberalized Remittance Scheme of February 4, 2004 amended from time to time.

* Buying and selling real estate and dealing in TDR (does not include township, residential and commercial premises, roads and bridges).

** However, Indian banks operating in India can set up JV/WOS abroad provided they obtain clearance under the Banking Regulation Act 1949.

Notes:

- Investment in Pakistan is allowed under the approval route

- Investments in Nepal can be only in Indian Rupees

- Investments in Bhutan are allowed in Indian Rupees and in freely convertible currencies.

ODI Components

Forms of ODI including financial commitment are:

- by way of contribution to equity shares or CCPS of the JV / WOS abroad

- contribution to the JV / WOS as preference shares (for reporting purpose to be treated as loan)

- as loans to its the JV / WOS abroad

- 100% of the amount of corporate guarantee issued on behalf of its overseas JV/WOS and

- 50% of the amount of performance guarantee issued on behalf of its overseas JV/WOS.

- bank guarantee/standby letter of credit issued by a resident bank on behalf of an overseas JV / WOS of the Indian party, which is backed by a counter guarantee / collateral by the Indian party

- amount of fund/ non fund based credit facility availed by creation of charge (pledge / mortgage / hypothecation) on the movable / immovable property or other financial assets of the Indian party / its group companies

Note: The amount and period of the guarantee should be specified upfront.

Permissible Sources For Funding Overseas Direct Investment

Funding for overseas direct investment can be made by one or more of the following sources:

- Drawal of foreign exchange from an AD bank in India.

- Swap of shares (refers to the acquisition of the shares of an overseas JV / WOS by way of exchange of the shares of the Indian party).

- Capitalization of exports and other dues and entitlements.

- Proceeds of External Commercial Borrowings / Foreign Currency Convertible Bonds.

- In exchange of ADRs / GDRs issued in accordance with the Scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 and the guidelines issued by Government of India in the matter.

- Balances held in Exchange Earners Foreign Currency account of the Indian Party maintained with an Authorized Dealer.

- Proceeds of foreign currency funds raised through ADR / GDR issues.

General Permissions

General permission has been granted to persons (individual) resident in India for purchase / acquisition of securities as under:

- Out of funds held in the RFC account;

- As bonus shares on existing holding of foreign currency shares;

- When not permanently resident in India, from the foreign currency resources outside India.

General permission is also available to sell the shares so purchased or acquired.

A resident Indian can remit, up to the limit prescribed by the Reserve Bank from time to time, per financial year under the Liberalised Remittance Scheme (LRS), for permitted current and capital account transactions including purchase of securities and also setting up/acquisition of JV/WOS overseas with effect from August 5, 2013 (vide Notification No. 263).

Conditions for making investment in ODI

By Indian Party:

- The total financial commitment of the Indian Party in Joint Ventures/Wholly Owned Subsidiaries shall not exceed 400%, or as decided by the Reserve Bank from time to time, of the net worth of the Indian Party as on the date of the last audited balance sheet;

- The direct investment should be made in an overseas JV or WOS engaged in a bonafide business activity;

- The Indian Party should not be on the Reserve Bank’s Exporters caution list /list of defaulters to the banking system circulated by the Reserve Bank or Credit Information Bureau (India) Ltd. (CIBIL) or any other credit information company or under investigation by any investigation /enforcement agency or regulatory body;

- The Indian Party must have submitted its Annual Performance Report in respect of all its overseas investments in the format given in Part III of the Form ODI;

- The Indian Party must route all transactions relating to the investment in a Joint Venture/Wholly Owned Subsidiary through only one branch of an authorized dealer to be designated by it

- The Indian Party must submit Part I of the Form ODI, duly completed, to the designated branch of an authorized dealer within 30 days of transaction.

By Resident Individual:

Individuals resident in India may invest by way of purchasing/acquiring shares of a foreign entity as a part/full consideration for rendering professional services or in lieu of director’s remuneration.

However, the aforesaid manner of acquiring such shares in terms of value shall be within the overall ceiling limit i.e. US$250,000 in a financial year as prescribed for the resident individuals under the Liberalized Remittance Scheme (LRS) in force at the time of acquisition.

In case the value of shares exceeds the limit mentioned under the LRS, such shares are to be acquired after the consent of the RBI.

Approval Route

If the conditions not fulfilled in Automatic route then the Indian Party shall seek prior approval of the RBI before making investment. Like Automatic root, the applicant should approach their designated Authorized Dealer (AD) with Form ODI along with the prescribed enclosures / documents for making such investments which shall then be submitted to RBI after due scrutiny by AD bank and with the specific recommendations of the designated AD bank along with supporting documents. The designated AD before forwarding the proposal should submit the Form ODI in the on-line OID application under approval route after which UIN will be given by RBI.

Reserve Bank would, inter alia, take into account the following factors while considering such applications:

- Prima facie viability of the JV / WOS outside India;

- Contribution to external trade and other benefits which will accrue to India through such investment (or financial commitment);

- Financial position and business track record of the Indian Party and the foreign entity; and

- Expertise and experience of the Indian Party in the same or related line of activity as of the JV / WOS outside India.

For approval by Reserve Bank, following documents need to be submitted along with Section D and Section E of Form ODI – Part I by the designated Authorized Dealer:

- A letter from the designated AD of the IP in a sealed cover mentioning the following details:

- Transaction number generated by the OID application.

- Brief details of the Indian entity.

- Brief details of the overseas entity.

- Background of the proposal, if any.

- Brief details of the transaction.

- Reason/s for seeking approval mentioning the extant FEMA provisions.

- Observations of the designated AD bank with respect to the following:

- Prima facie viability of the JV/ WOS outside India;

- Contribution to external trade and other benefits which will accrue to India through such investment;

- Financial position and business track record of the IP and the foreign entity;

- Expertise and experience of the IP in the same or related line of activity of the JV/ WOS outside India

- Recommendations of the designated AD bank.

- A letter from the IP addressed to the designated AD bank.

- Board resolution for the proposed transaction/s.

- Diagrammatic representation of the organisational structure indicating all the subsidiaries of the IP horizontally and vertically with their stake (direct & indirect) and status (whether operating company or SPV).

- Incorporation certificate and the valuation certificate for the overseas entity (if applicable).

- Other relevant documents properly numbered, indexed and flagged.

ODI Transactions that Require RBI Approval

Some of the proposals which require prior approval are:

- Real Estate Business

- Banking Business

- Overseas Investments in the energy and natural resources sector exceeding the prescribed limit of the net worth of the Indian companies as on the date of the last audited balance sheet;

- Investments in Overseas Unincorporated entities in the oil sector by resident corporate exceeding the prescribed limit of their net worth as on the date of the last audited balance sheet, provided the proposal has been approved by the competent authority and is duly supported by a certified copy of the Board Resolution approving such investment. However, Navaratna Public Sector Undertakings, ONGC Videsh Ltd and Oil India Ltd are allowed to invest in overseas unincorporated / incorporated entities in oil sector (i.e. for exploration and drilling for oil and natural gas, etc.), which are duly approved by the Government of India, without any limits, under the automatic route;

- Overseas Investments by proprietorship concerns and unregistered partnership firms satisfying certain eligibility criteria;

- Investments by Registered Trusts / Societies (satisfying certain eligibility criteria) engaged in the manufacturing / educational / hospital sector in the same sector in a JV / WOS outside India;

- Corporate guarantee by the Indian Party to second and subsequent level of Step Down Subsidiary (SDS);

- All other forms of guarantee which is offered by the Indian Party to its first and subsequent level of SDS;

- Restructuring of the balance sheet of JV/WOS involving write-off of capital and receivables in the books of listed/ unlisted Indian Company satisfying certain eligibility criteria mentioned under Regulation 16A of notification ibid;

- Capitalization of export proceeds remaining unrealized beyond the prescribed period of realization will require the prior approval of the Reserve Bank; and

- Proposals from the Indian party for undertaking financial commitment without equity contribution in JV / WOS may be considered by the Reserve Bank under the approval route based on the business requirement of the Indian Party and legal requirement of the host country in which JV/WOS is located.

Obligations of the Indian Party

An Indian Party will have to comply with the following: –

- receive share certificates or any other documentary evidence of investment in the foreign JV / WOS as an evidence of investment and submit the same to the designated AD within 6 months;

- repatriate to India, all dues receivable from the foreign JV / WOS, like dividend, royalty, technical fees etc.;

- submit to the Reserve Bank through the designated Authorized Dealer, every year, an Annual Performance Report in Part III of Form ODI in respect of each JV or WOS outside India set up or acquired by the Indian party. Revised Instructions for APR filing has been issued vide P.(DIR Series) Circular No. 61 dated April 13, 2016

- report the details of the decisions taken by a JV/WOS regarding diversification of its activities /setting up of step down subsidiaries/alteration in its share holding pattern within 30 days of the approval of those decisions by the competent authority concerned of such JV/WOS in terms of the local laws of the host country. These are also to be included in the relevant Annual Performance Report; and

- in case of disinvestment, sale proceeds of shares/securities shall be repatriated to India immediately on receipt thereof and in any case not later than 90 days from the date of sale of the shares /securities and documentary evidence to this effect shall be submitted to the Reserve Bank through the designated Authorised Dealer.

The various filing requirements in ODI

- Form ODI Part I– Application for making overseas direct investments and reporting of Remittances/ Transactions to be submitted by the applicant to the RBI

- Form ODI Part II– Annual Performance Report (APR) – To be submitted, certified by Statutory Auditors of the Indian party, through the designated AD Category– I bank every year by June 30th as long as the JV / WOS is in existence.

- Form ODI Part III – Report on disinvestment by way of closure/ voluntary liquidation, winding up of the JV/WOS abroad/ sale / transfer of the shares of the overseas JV/ WOS to another eligible resident or non-resident/ Buy back of shares by the overseas JV/ WOS of the IP/RI .

Annual Performance Reports (APR)

An Indian Party (IP) / Resident Individual (RI) which has made an Overseas Direct Investment (ODI) has to submit an Annual Performance Report (APR) in Form ODI Part III to the Reserve Bank by 30th of June every year in respect of each Joint Venture (JV) / Wholly Owned Subsidiary (WOS) outside India set up or acquired by the IP / RI (as prescribed under Regulation 15 of FEMA Notification, ibid).

Where the law of the host country does not mandatorily require auditing of the books of accounts of JV / WOS, the Annual Performance Report (APR) may be submitted by the Indian party based on the un-audited annual accounts of the JV / WOS provided:

- The Statutory Auditors of the Indian party certify that the law of the host country does not mandatorily require auditing of the books of accounts of JV/WOS and the figures in the APR are as per the un-audited accounts of the overseas JV/WOS.

- That the un-audited annual accounts of the JV / WOS has been adopted and ratified by the Board of the Indian party.

- The above exemption from filing the APR based on unaudited balance sheet will not be available in respect of JV/WOS in a country/jurisdiction which is either under the observation of the Financial Action Task Force (FATF) or in respect of which enhanced due diligence is recommended by FATF or any other country/jurisdiction as prescribed by Reserve Bank of India.

Delayed submission/ non-submission of APRs entail penal measures, as prescribed under FEMA 1999, against the defaulting Indian Party.

Different Modes of Disinvestments from the JV / WOS Abroad

Disinvestment by the Indian party from its JV / WOS abroad may be by way of

- by way of transfer / sale of equity shares to a non-resident / resident or

- by way of liquidation / merger / amalgamation of the JV / WOS abroad.

Disinvestment from JV/WOS without writes off

The Indian Party may disinvest without write off under the automatic route subject to the following:

- the sale is effected through a stock exchange where the shares of the overseas JV/ WOS are listed;

- if the shares are not listed on the stock exchange and the shares are disinvested by a private arrangement, the share price is not less than the value certified by a Chartered Accountant / Certified Public Accountant as the fair value of the shares based on the latest audited financial statements of the JV / WOS;

- the Indian Party does not have any outstanding dues by way of dividend, technical know-how fees, royalty, consultancy, commission or other entitlements and / or export proceeds from the JV or WOS;

- the overseas concern has been in operation for at least one full year and the Annual Performance Report together with the audited accounts for that year has been submitted to the Reserve Bank;

- the Indian party is not under investigation by CBI / DoE/ SEBI / IRDA or any other regulatory authority in India; and

- other terms and conditions prescribed under Regulation 16 of the Notification ibid.

Disinvestment from JV/WOS involving writes off

An Indian Party may disinvest, under the automatic route, involving write off in the under noted cases:

- where the JV / WOS is listed in the overseas stock exchange;

- where the Indian Party is listed on a stock exchange in India and has a net worth of not less than Rs.100 crore;

- where the Indian Party is an unlisted company and the investment in the overseas JV / WOS does not exceed USD 10 million; and

- where the Indian Party is a listed company with net worth of less than Rs.100 crore but investment in an overseas JV/WOS does not exceed USD 10 million.

Source:

https://m.rbi.org.in/scripts/FAQView.aspx?Id=32

https://www.rbi.org.in/scripts/FAQView.aspx?Id=17

Click here to Download the ODI Form

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. We shall not be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information in any circumstances.

Practicing Company Secretary, M.Com and Commerce Graduate and founder at Shaffy Mehta & Co. She is having an overall 4 years experience of Company Law and other Corporate Laws.