Every company having foreign investment (FDI), is required to report the Reserve Bank of India. Foreign Direct Investment of upto 100% is allowed into Indian Private Limited Company and Limited company for most of the sectors. The amount of FDI into India has increased manifold over the last few years due to a booming economy and welcoming environment for foreign investors.

The Reserve Bank of India (RBI) vide A.P (DIR Series) Circular No. 30 dated June 07, 2018 (FDI Circular) simplified the foreign investment reporting by the Indian entities, by consolidating 9 different forms viz., FCGPR Form, FCTRS Form, LLP (I) Form, LLP (II) Form, CN Form, DRR Form, ESOP Form, DI Form and INVI Form, in one master form, namely Single Master Form (SMF), through which the Indian entities can do foreign investment reporting, without using the digital signature certificates of the authorised signatories. With the introduction of the SMF, the RBI also dispensed with the requirement of filing the advance reporting form by the Indian companies.

What is FC-GPR?

Foreign currency Gross provisional Return (FC-GPR) is a form in which a company is required to submit with RBI for reporting of the issue of eligible instruments to the overseas investor against any FDI inflow within the 30 days from the date of issue of securities.

When FC-GPR Form is required to be filed?

Below mentioned are the cases when FC-GPR form is required to be filed;

- In the case of incorporation if Shareholder is non-resident:

After incorporation, the Company needs to open a Bank Account. After subscription money received in the Bank Account, there is a need for reporting with RBI in FC-GPR form. Under FEMA, in case of newly incorporated companies, there is no timeline for bringing in the Subscription money whereas, Under the Companies Act 2013, there is a mandatory requirement for the subscribers to bring in subscription amount in 180 days from the date of incorporation.

- In case of further issue of Shares:

Only the following Securities considered under FDI (Foreign Direct Investment):

In case Share Application money is received, shares required to be allotted in 60 days from the date of receipt of application money. As soon as shares are allotted, there is a need for reporting with RBI in FC-GPR form within 30 days of allotment.

- Equity Shares

- Convertible Preference Shares

- Convertible Debentures

Investment in any other instrument shall be treated as borrowings and need to fulfill ECB requirements.

Documents/Information required at the time of filing FC-GPR

- Unique Identification Number which is given once reporting of Advanced Foreign Remittance has been done to RBI.

- Copy of KYC

- Copy of FIRC from the AD Bank

- Certificate from Company Secretary at all the requirements of the Companies Act, 2013 has been complied with. In case a Company has appointed a Company Secretary, then such Company Secretary may issue such Certificate. Otherwise the Company has to procure such certificate from the Practicing Company Secretary

- Certificate from SEBI registered Merchant Banker / Chartered Accountant indicating the manner of arriving at the price of the shares issued to the persons resident outside India.

- Declaration from Director

- Board resolution for Allotment of Securities

- List of Allottees

- Statutory Auditor Certificate

- Valuation certificate: As prescribed and applicable under FEMA 20(R). To be attached at “Valuation certificate”. For rights issue, valuation certificate is not required. A declaration (plain paper) may be attached that the rights issue to persons resident outside India is not at a price less than the price offered to persons resident in India.

- No objection certificate from the remitter for the shares being allotted to the third party mentioning their relationship;

- Letter from the foreign investor explaining the reason for making subscription to shares by the remitter on his behalf

- Copy of agreement/Board resolution from the investee company for issue and allotment of shares to the foreign investor, other than the remitter

- Details of Transfer of shares if any.

- LRN(Loan Registration Number) allotted

- Copy of FIPB approval (if required)

- Merger/ Demerger/ Amalgamation: relevant extracts to be attached at the specified attachment “relevant approvals from the competent authority”.

- Memorandum of Association: if applicable. Relevant extracts to be attached as “other attachment”.

- Reason for delay in submission (if required)

Steps for filing form FC-GPR with RBI

Registration for Business User:

Step 1: Registration for Business User

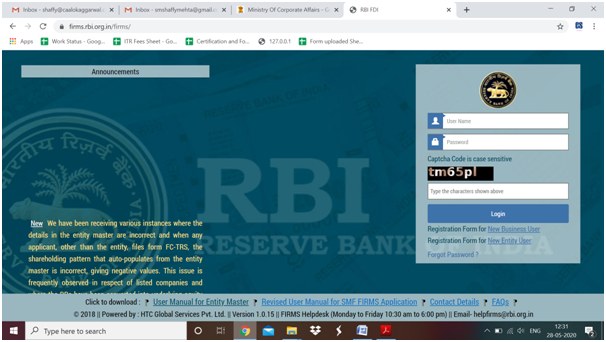

For Registration for Business User go to the FIRMS website at https://firms.rbi.org.in

Step 2: Registration for Business User

At the Login box, you need to click on the Registration form with New Business User.

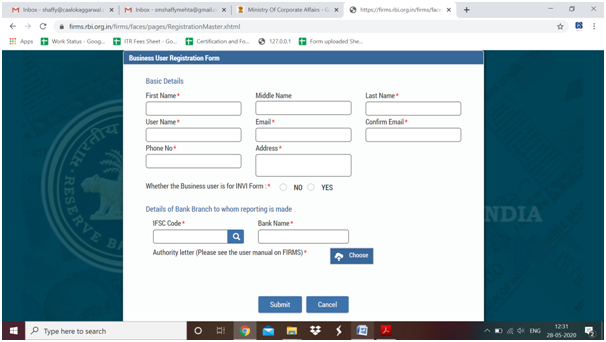

Step 3: Fill up the details in the popped up registration form for BU as below

- Name

- User Name

- Confirm email

- Phone No

- Address

- Whether the Business user is for InVi Form- Select YES/NO

- IFSC code of the Bank branch with whom the reporting would be made.

- Bank name

- Authority letter as an Attachment

- Company CIN/LLPIN

- PAN Number

- Entity name

Step 4: Click Submit button. In case any error is displayed, rectify the same and click Submit button.

Step 5: A Message “Record Saved Successfully” is displayed on top of the Login box.

AD Bank Branch will verify the same. Approval communicated with the Email notification with the Business user

Logging into Firms:

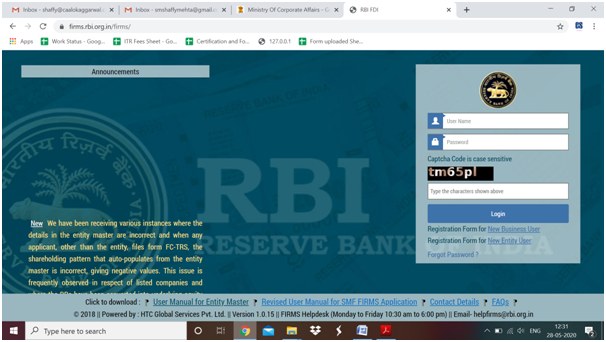

Step 1: Go to the FIRMS website at https://firms.rbi.org.in

Step 2: User Name and the Default password is received via Email, Enter captcha and click submit. Please do not copy paste the password, instead type the same.

Step 3: Business users can set a new password.

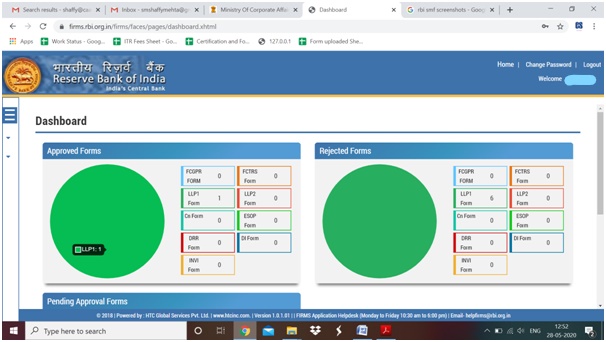

Step 4: After Logging in to FIRMS, it will create a workplace

Form Filing and Submission:

Step 1: Login into SMF and reach your workspace. Click on the left navigation button and select Single Master Form.

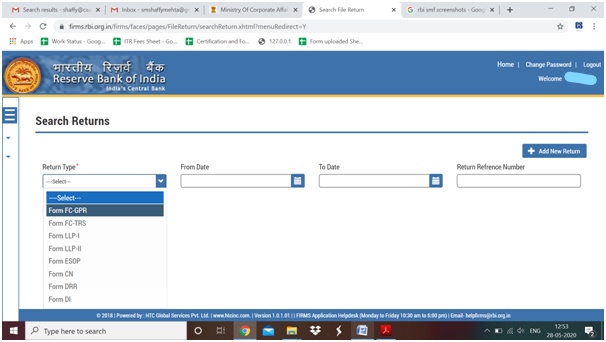

Step 2: Select the Return type- Select FC-GPR, the user will be taken to the Form FC-GPR.

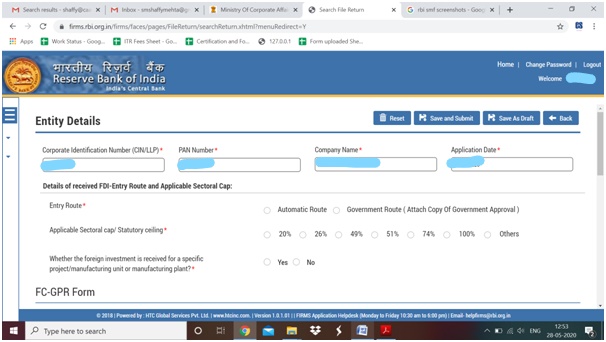

Step 3: Fill the Common Investment details.

These details are common to all the returns that can be reported in SMF in FC-GPR form fill up the common investment details such as shareholding pattern, Date of issue of shares etc.

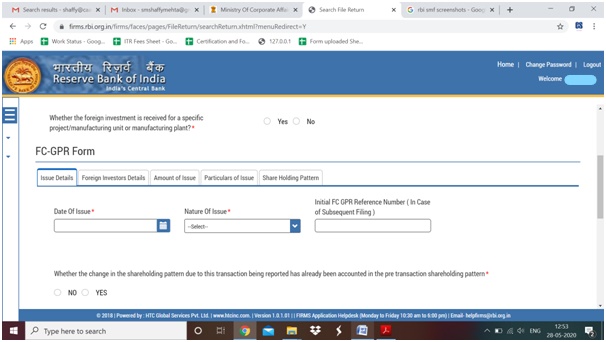

Step 4: Issue Details

Issue details such as Date of Issue, Nature of Issue, Initial FC-GPR Reference No. in case of subsequent filing. Whether the change in the shareholding pattern due to this transaction being reported has already been accounted in the pre transaction shareholding pattern.

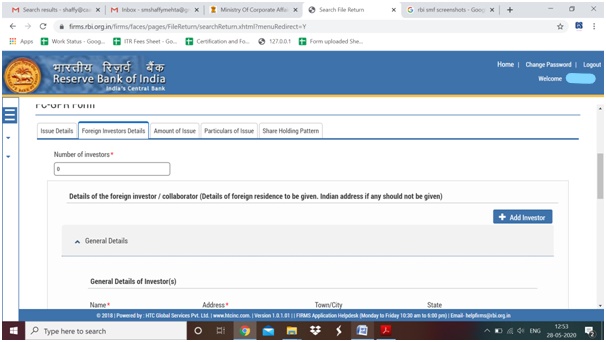

Step 5: Foreign Investors Details

Foreign Investor details such as number of investors, General details like Name Address Country of residence, Constitution/nature of the investing entity, etc. are required to be filled.

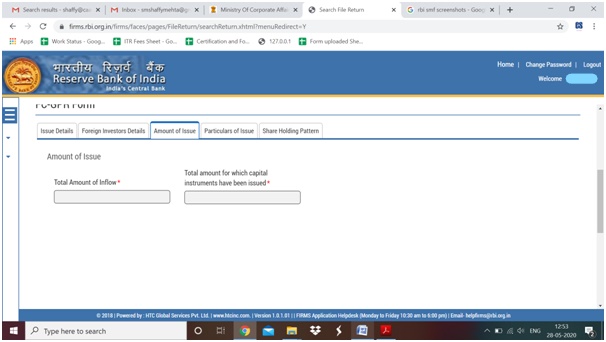

Step 6: Amount of Issue

Fill the total amount of inflow and the total amount for which the capital instruments have been issued.

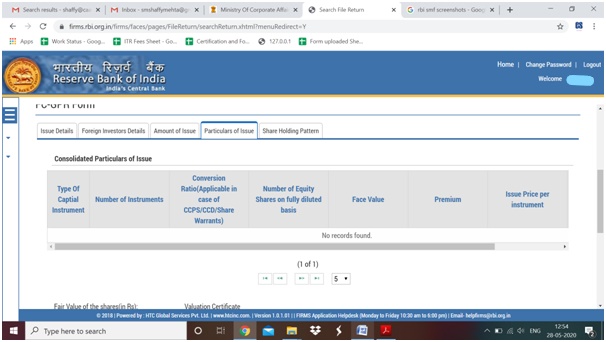

Step 7: Particulars of Issue

- There would be an auto populated table for the consolidated particulars of issue.

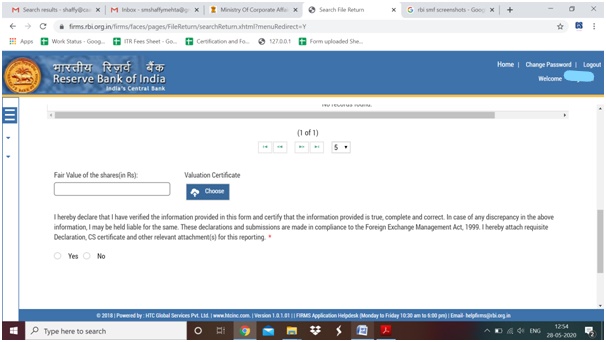

- Fair value of the shares to be filled as per the valuation certificate issued by the person authorized as per FEMA 20 (R) along with the attachment at “Valuation Certificate”.

- And lastly, there would be a declaration by the CS.

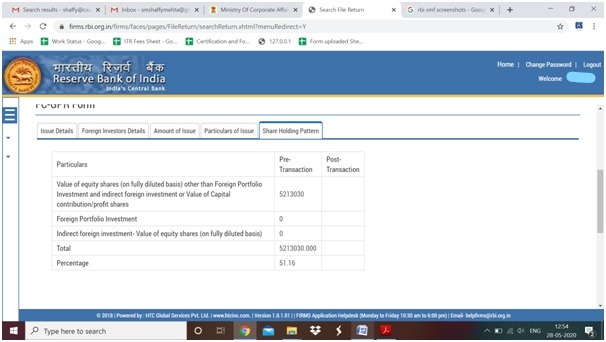

Step 8: Shareholding Pattern

- Value of equity shares (on fully diluted basis) other than Foreign Portfolio Investment and indirect foreign investment or Value of Capital contribution/profit shares, Foreign Portfolio Investment, Indirect foreign investment- Value of equity shares (on fully diluted basis)

- Pre transaction values are auto-populated from the Entity Master (Tab 3)

- Post transaction values are auto-calculated based upon the details provided in the form. Post transaction= Pre transaction value of shares + Value of shares reported in the form

The Business user shall ensure that the details are correctly filled in the form, so that the shareholding pattern which is auto- calculated is correct. For any incorrect details the Business user would be liable for the same.

Step 8: Submitting the Form.

After filling in all details, click on the Save and Submit for submitting the form.

Penalty for Non Filing/Delay in reporting of FC-GPR

Delay in reporting beyond the prescribed period (30 days from issue of shares in case of report FC-GPR) shall attract a penalty of 1% of the total amount of investment subject to a minimum of Rs. 5,000 and maximum of Rs 5,00,000 per month or part thereof for the first six month of delay and twice that rate thereafter, to be paid online into a designated account in Reserve Bank of India.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. In no event, we shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.

Practicing Company Secretary, M.Com and Commerce Graduate and founder at Shaffy Mehta & Co. She is having an overall 4 years experience of Company Law and other Corporate Laws.