Data for Import of Goods GSTR-2A

Taxpayers can now view their bill of entries data which is received by the GST System (GSTN) from Indian Customs Electronic Gateway (ICEGATE) System (Customs).

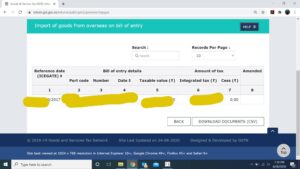

Two new tables have been inserted in GSTR-2A for displaying details of

- Import of goods from overseas and

- Inward supplies made from SEZ units / SEZ developers

Currently, the system is displaying data up to 6th August, 2020.

Snapshot availability of data for import of goods in Form GSTR-2A

The present data upload has been done on a trial basis to give a feel of the functionality and to get feedback from the taxpayers on the same.

Integration with ICEGATE has enabled portal to display data for bill of entries from the beginning GST was implemented since July, 2017.

Snapshot having import data for period July -2017.

Following Facility to be available soon

System currently does not contain import information for

- Bill of entries filed at non-computerized ports (non-EDI ports);

- Imports made through courier services/post office &

- Amendment information Made in the details of bill of entries

Taxpayers are requested that they share their feedback through raising a ticket on the self-service portal (https://selfservice.gstsystem.in/)

Download Press Release on Import data in GSTR-2A

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. We shall not be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information in any circumstances.

Yes GST is an online portal which aims to provide all information about (GST) and other laws in India. Our endeavor is to spread knowledge