About GSTR-2B | (Auto drafted ITC Statement)

GSTR-2B is an auto-drafted ITC statement which will be generated for every registered person on the basis of the information furnished by his suppliers in their respective GSTR-1, 5 (non-resident taxable person) and 6 (input service distributor).

It is a static statement and will be made available for each month, on the 12th day of the succeeding month. For example, for the month of July 2020, the statement will be generated and made available to the registered person on 12th August 2020.

The statement will indicate availability of input tax credit to the registered person against each document filed by his suppliers.Details of all the documents in GSTR-2B is made available online as well as through download facility.

There may be scenarios where a percentage of the applicable rate of tax rate may be notified by the

Government. A separate column will be provided for invoices / documents where such rate is applicable.

GSTR-2B for the month of July 2020 has been made available on the common portal on trial basis. Since, this is the first time that the statement is being introduced, taxpayers are advised to refer to GSTR-2B for the month of July, 2020 only for feedback purposes .

All taxpayers are requested to go through their GSTR-2B for July 2020 and after comparing the same with the credit availed by them in July 2020, provide feedback (if any) on any aspect of GSTR-2B by raising a ticket on the self-service portal (https://selfservice.gstsystem.in/).

Key features of GSTR-2B

- It contains information on import of goods from the ICEGATE system including inward supplies of goods received from Special Economic Zones Units / Developers.

- A summary statement which shows all the ITC available and non-available under each section.

- Document level details of all invoices, credit notes, debit notes etc. is also provided both for viewing and download;

Transactions Not included in FORM GSTR-2B

- Reverse charge credit on import of services

- Import of goods (for July month only) it shall be available for GSTR-2B of August, 2020 onwards (to be generated on 12th September, 2020)

- Documents filed by supplier in their respective GSTR-1 , GSTR-5 & GSTR-6 on or after the 12th of the next month (it shall be available in GSTR-2B for the Next month)

- Ineligible ITC, tax payers are advised to self assess and reverse accordingly in returns

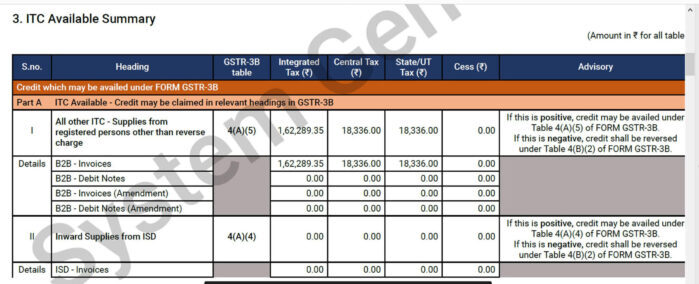

ITC Available summary

Credit that may be availed in FORM GSTR-3B

- All other ITC – Supplies from registered persons other than reverse charge

- Inward Supplies from ISD

- Inward Supplies liable for reverse charge

- Import of Goods

Credit that shall be reversed in FORM GSTR- 3B

Summary of ITC not available

- Invoice or debit note for supply of goods or services or both furnished after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains (Section 16(4) of the CGST Act, 2017)

- Invoice or debit note where the Supplier (GSTIN) and place of supply are in the same State while recipient is in another State

However, there may be other scenarios for which input tax credit may not be available to the taxpayers and the same has not been generated by the system. Taxpayers, are advised to self-assess and reverse such credit in their FORM GSTR-3B.

Read Relevant Article on Importance and Relevance of State Code & Place of Supply

Navigation Path : Login to GST Portal > Returns Dashboard > Select Return period >GSTR-2B.

Download Press Release on Launch of GSTR-2B for the month of July 2020

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. We shall not be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information in any circumstances.

Yes GST is an online portal which aims to provide all information about (GST) and other laws in India. Our endeavor is to spread knowledge