Why ITC-02A has to be filed?

if registered person intends to transfer the unutilized ITC lying in Electronic Credit Ledger to newly registered place of business then details in Form ITC-02A has to be furnished.

To whom this facility is available?

This facility is available only to such registered person who has obtained separate registration for multiple place of business in accordance with Rule 11 of the CGST Rules, 2017.

Time Limit to file?

Form ITC-02A has to be filed within a period of thirty days from obtaining such separate registrations.

What are the Conditions to avail such facility?

ITC shall be transferred to newly registered entities in the ratio of the value of assets held by them at time of registration.

What is the Meaning of Value of Assets?

Value of assets means the value of the entire assets of the business whether or not input tax credit has been availed thereon.

When Rule 41A was inserted in CGST Rules, 2017?

Rule 41A of The CGST Rules, 2017 was inserted vide Notification no. 03/2019-CT dt. 29.01.2019 w.e.f. 01.02.2019

What Action has to be taken by transferee ?

The newly registered person (transferee) has to accept the details furnished by transferor and unutilized ITC shall be credited to his Electronic Credit Ledger.

Relevant Rules: Rule 11 and Rule 41A of the CGST Rules, 2017 has been mentioned below for quick reference by readers

Rule 41A. Transfer of credit on obtaining separate registration for multiple places of business within a State or Union territory

“(1) A registered person who has obtained separate registration for multiple places of business in accordance with the provisions of rule 11 and who intends to transfer, either wholly or partly, the unutilised input tax credit lying in his electronic credit ledger to any or all of the newly registered place of business, shall furnish within a period of thirty days from obtaining such separate registrations, the details in FORM GST ITC-02A electronically on the common portal, either directly or through a Facilitation Centre notified in this behalf by the Commissioner:

Provided that the input tax credit shall be transferred to the newly registered entities in the ratio of the value of assets held by them at the time of registration.

Explanation.- For the purposes of this sub-rule, it is hereby clarified that the ‗value of assets‘ means the value of the entire assets of the business whether or not input tax credit has been availed thereon.

(2) The newly registered person (transferee) shall, on the common portal, accept the details so furnished by the registered person (transferor) and, upon such acceptance, the unutilised input tax credit specified in FORM GST ITC-02A shall be credited to his electronic credit ledger.]”

User Manual on Filing of Form ITC-02A by GST Portal

FAQ on filing of Form ITC-02A by GST Portal

Click here to download Form ITC-02A

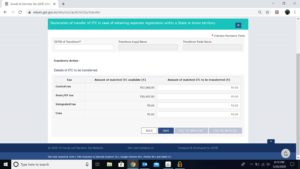

Screenshot of functionality available on portal

Form ITC-02A on GST Portal

(Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. In no event, we shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information.)

Mr. Setia is a CA by Profession and expert in the field of Indirect Taxation Based in Delhi. Rich experience of over 5 year.