A. Due to COVID-19 pandemic and challenges faced by taxpayers, Government has extended dates for opting for composition scheme by normal taxpayers, for the financial year 2020-21. These are notified in Notifications 30/2020 Central Tax, dated 03.04.2020. Circular No. 136/06/2020-GST dated 3rd April, 2020 has also been issued.

B. Existing Normal taxpayers who want to opt for Composition Scheme in Financial Year 2020-21 may note following changes:

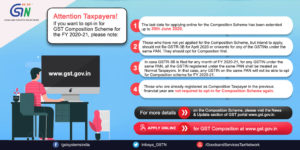

Revised date to file Form GST CMP 02: Normal and registered taxpayers who want to opt in for Composition in FY 2020-21 can apply in Form GST CMP-02 by 30th June 2020.

- No GSTR 1 or 3B must be filed in 2020-21 financial year for associated PAN: The taxpayers SHOULD NOT file any GSTR-1/GSTR-3B, for any tax period of FY 2020-21, from any of the GSTIN on the associated PAN, or else they will not be able to opt for composition scheme for FY 2020-21.

- No need for re-opting for the composition scheme: The taxpayers who are already in composition scheme, in previous financial year are not required to opt in for composition again for FY 2020-2021.

- Revised date to file Form GST ITC 03: Form GST ITC-03 to reverse ITC for the stock in hand at the time of transition can be filed till 31st July, 2020.

Modification in earlier advisory date 18.02.2020: The advisory issued on 18.02.2020 and available on GST Portal (click here for the link https://www.gst.gov.in/newsandupdates/read/356) stands modified to above extent.

Source: GST Portal

Yes GST is an online portal which aims to provide all information about (GST) and other laws in India. Our endeavor is to spread knowledge