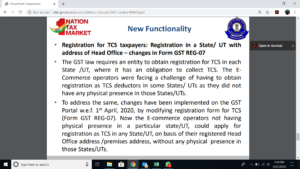

The GST law requires an entity to obtain registration for TCS in each State /UT, where it has an obligation to collect TCS. The ECommerce operators were facing a challenge of having to obtain

registration as TCS deductors in some States/ UTs as they did not have any physical presence in those States/UTs.

• To address the same, changes have been implemented on the GST Portal w.e.f. 1 st April, 2020, by modifying registration form for TCS (Form GST REG-07). Now the E-commerce operators not having

physical presence in a particular state/UT, could apply for registration as TCS in any State/UT, on basis of their registered Head Office address /premises address, without any physical presence in those States/UTs.

Yes GST is an online portal which aims to provide all information about (GST) and other laws in India. Our endeavor is to spread knowledge