Full Text of the Notification

“In exercise of the powers conferred by sub-section (2) of section 1 of the Finance (No. 2) Act, 2019 (23 of 2019), the Central Government hereby appoints the 1st day of September, 2020, as the date on which the provisions of section 100 of the Finance (No. 2) Act, 2019 (23 of 2019), shall come into force.”

Section 100 of the Finance (No. 2) Act, 2019

In section 50 of the Central Goods and Services Tax Act, in sub-section (1), the following proviso shall be inserted, namely:–

“Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.”

Decision in 39th GST Council Meeting Dated 14th March, 2020

Clause 1(a)

“Interest for delay in payment of GST to be charged on the net cash tax liability w.e.f. 01.07.2017 (Law to be amended retrospectively)”

Click here to download Press Release on Decisions taken in 39th GST Council Meeting

Analysis of provisions

Proviso inserted to Section 50 of the Central Goods and Services Tax, 2017

It is Important to note that interest shall be levied on that portion of tax which is paid by debiting the electronic cash ledger (i.e. net liability), only if tax payable on supplies made during a tax period is declared in the return for the said period.

It is important to mention here that interest shall be levied on gross liability; if liability for tax period is disclosed in any period other than the period to which it pertains.

Therefore taxpayers must pay attention that benefit of interest on net liability is available if liability for the period is declared in the same period.

Another point which requires attention is that benefit of Interest on Net Liability is not available when return is furnished after the commencement of any proceedings under section 73 or 74 for the said period. In other words interest shall be levied on gross liability where return is furnished consequent to commencement of proceedings under section 73 or section 74 of the Central Goods and Services Tax Act, 2017.

Provisions relating to Interest on net tax liability shall be applicable retrospective w.e.f. 1st July, 2017; as per the Decision taken by the 39th GST Council Meeting dated 14th March, 2020 applicable Retrospectively. Wheres the Notification specifies that Section 100 of the Finance (No. 2) Act, 2019 shall be applicable prospectively w.e.f. 1st September, 2020.

Decisions of the GST Council meeting does not coincide with the Notification No. 63/2020 – Central Tax -Dated 25th August, 2020.

Click here to Download Notification No. 632020 – Central Tax-Dated 25th August, 2020

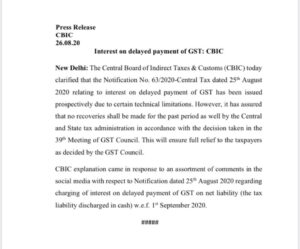

Press Release

CBIC 26.08.20 | Interest on delayed payment of GST: CBIC

New Delhi: The Central Board of Indirect Taxes & Customs (CBIC) today clarified that the Notification No. 63/2020-Central Tax dated 25th August 2020 relating to interest on delayed payment of GST has been issued prospectively due to certain technical limitations.

However, it has assured that no recoveries shall be made for the past period as well by the Central and State tax administration in accordance with the decision taken in the 39th Meeting of GST Council.

This will ensure full relief to the taxpayers as decided by the GST Council.

CBIC explanation came in response to an assortment of comments in the social media with respect to Notification dated 25th August 2020 regarding charging of interest on delayed payment of GST on net liability (the tax liability discharged in cash) w.e.f. 1 September 2020.

Click here to View Press Release

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided. Neither Author nor Yes GST (collectively referred as we) assume no responsibility thereof. The user of the information agrees that the information is not a professional advice and is subject to change without notice. We shall not be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information in any circumstances.

Mr. Setia is a CA by Profession and expert in the field of Indirect Taxation Based in Delhi. Rich experience of over 5 year.